Inhaltsverzeichnis

DSFinV-K

Legal basis

The DSFinV-K is the description of an interface for the export of data from electronic recording systems for data carrier transfer („Z3 access“) in the context of external audits and cash register inspections. It is intended to ensure uniform structuring and labelling of the files and data fields regardless of the electronic recording system used by the company. The company must provide the data on a suitable data carrier in accordance with the conventions of the DSFinV-K.

Further information is available on the BZSt website: Digitale Interface of the tax authorities for cash register systems (DSFinV-K)

Overview of

Article Indicator

You can find out how to book the TSE installation date and what preparations you can make here hier.

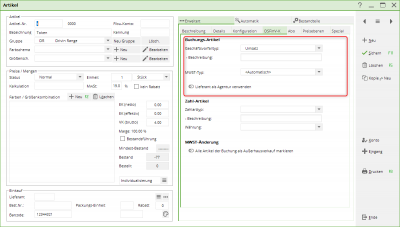

Booking article

For each booking article, a business transaction (GV_TYP/GV_NAME) must be defined for each booking item: You can find more detailed descriptions of the types of business transactions here: Definition of business transactions |

- Turnover

- Deposit

- Deposit refund

- Discount

- Surcharge

- SubsidyReal

- AllowanceNon

- TipAG

- TipAN

- Single-purpose voucherPurchase

- Single-purpose voucher redemption

- Multipurpose voucherPurchase

- Multi-purpose voucher redemption

- Receivables creation

- Debt cancellation

- Down payment cancellation

- Down payment cancellation

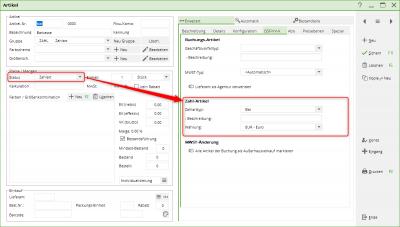

Article payment type

For payment type Article the payment method and the currency must be set.

The following options can be selected as the payment method:

- Cash

- Non-cash

- None

- EC card

- Credit card

- Electronic payment service provider

- Prepaid card

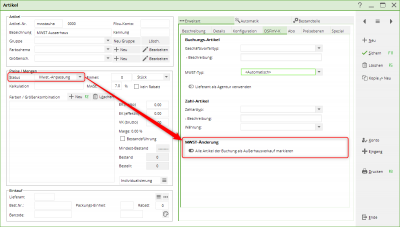

VAT article

In PC CADDIE, postings are by default recognised as in-house sales are posted as in-house sales.

For a VAT article, you can specify whether the associated articles are to be posted as out-of-house sales are to be posted as out-of-home sales.

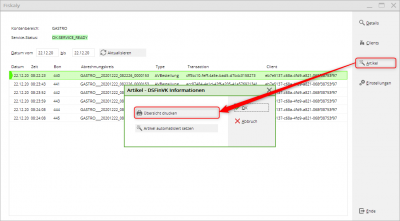

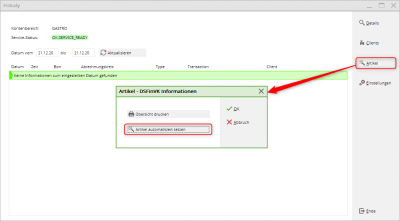

Print list

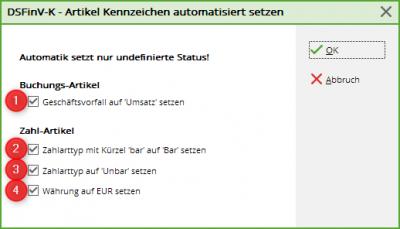

Set article indicators automatically

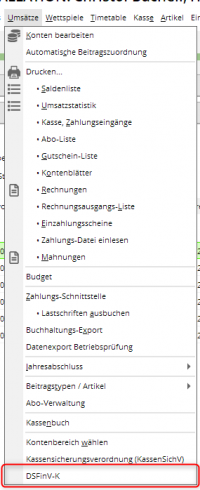

The automatic function can be found in the overview under the Articles menu item.

- Sets the business transaction Sales for all booking articles (if none has been set yet).

- Sets the payment article with the search abbreviation „bar “ to the payment type type Bar (if none is set yet).

- Sets the payment type type non-cash for other payment articles (if none is set yet).

- Sets the currency to Euro for all payment items (if none is set yet).

Export

Upgrade to Fiskaly Version 2

Install PC CADDIE current version

Please download the latest PC CADDIE update under the menu item End and Update PC CADDIE.

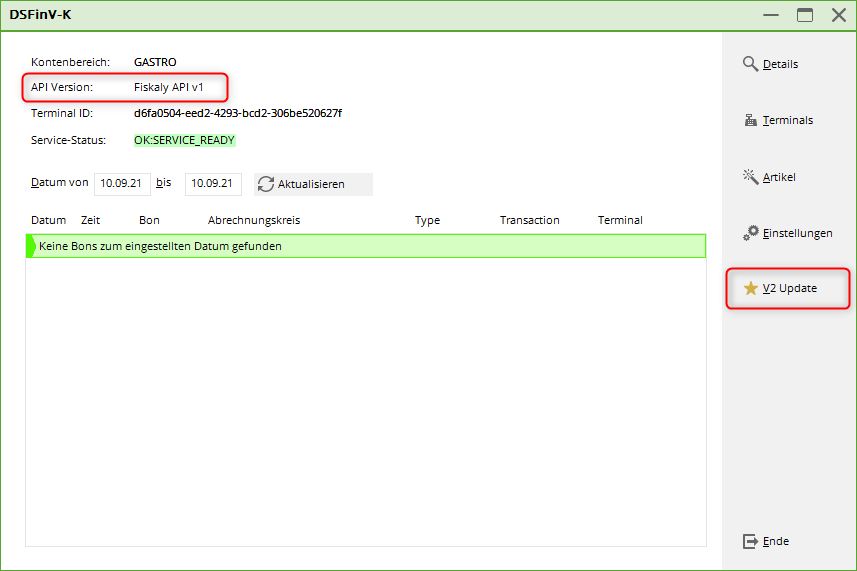

Call up update dialogue

Open the DSFinV-K dialogue via the menu Turnover → DSFinV-K

If this account area is still being used with the Fiskaly API v1 the button V2 Update. Please click the button V2 Update.

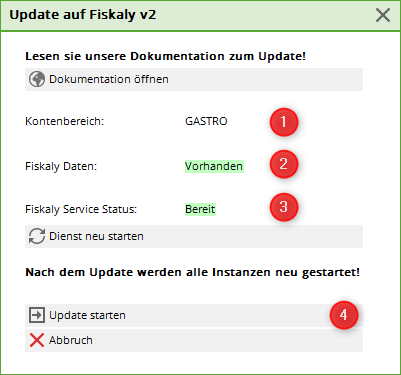

Update dialogue

- Keine Schlagworte vergeben